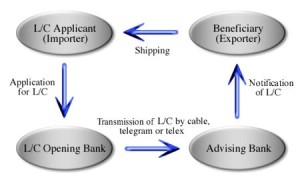

The letters of credit for import are the documents of assurance issued by the bank of the buyer to seller to assure him of the delivery of the payment for the products and services exported by him through his bank after the maturity of the transaction. The buyer and seller get into a contractual agreement to mature the transaction as per the terms and conditions of the agreement. In other words, if you are the beneficiary of the letter of credit opened you will receive the amount at the agreed time through the bank of the buyer. The guidelines of Uniform Customs and Practice of Documentary Credit of International Chamber of Commerce or UCP 600 help in handling all the letters of credit used in export-import trade.

Types of letters of credit

Various types of letters of credit are used in the business circle these days. Irrevocable, revocable, unconfirmed, confirmed, fixed, clean and documentary, transferable, revolving and back to back, etc. are some of the letters of credit commonly used to assure the payments to the seller. But still Irrevocable Letter of Credit is commonly used around the globe for the benefit of both buyer and seller.

When can seller get the money from Letter of Credit?

The period of credit is decided at the time of signing an agreement between the buyer and the seller. So the time of effective payment is determined by the bank of the opening account on the basis of the decision made at the time of the agreement.

Duration of the Credit period under Letter of Credit

The mutually agreed terms and conditions between the buyer and the seller before the actual commencement of a transaction can help in determining the duration credit period under the letter of credit. In fact the total period of credit, as per government regulations, should not be more than 180 days but a foreign buyer can opt for 30, 60, 90 or 120 days as period of credit in certain transactions.

The mutually agreed terms and conditions between the buyer and the seller before the actual commencement of a transaction can help in determining the duration credit period under the letter of credit. In fact the total period of credit, as per government regulations, should not be more than 180 days but a foreign buyer can opt for 30, 60, 90 or 120 days as period of credit in certain transactions.

Usually, they consider the date of shipment to calculate the period of credit under the letter of credit. The date of the airway bill or bill of lading can help in determining the date of shipment.

So a buyer can open letters of credit for import as per the terms and conditions of the international business with his bank to assure the seller to get the payment of the products and services exported by him through his bank.…